There’s

Nothing in the New ‘Tinkerbell’ Tax Law Forcing Companies to Bring Back Jobs

from Overseas

By

Terry H. Schwadron, New York Editor

Despite promises of

“America First” and claims that the new tax law will draw companies who moved

overseas back to this country with their wealth and jobs, there is some

evidence that the exodus of jobs may continue.

Despite promises of

“America First” and claims that the new tax law will draw companies who moved

overseas back to this country with their wealth and jobs, there is some

evidence that the exodus of jobs may continue.

Actually, there is

nothing in the tax law, other than the new rates themselves, that compels

companies with holdings overseas to move back.

And, despite a couple of announcements of companies with plans to do so, there are others moving ahead despite calls from Trump. A Washington Post analysis last week suggested that the tax plan actually may spur more companies to move overseas.

And, despite a couple of announcements of companies with plans to do so, there are others moving ahead despite calls from Trump. A Washington Post analysis last week suggested that the tax plan actually may spur more companies to move overseas.

“Presidential jawboning has been no match for the market,” David J. Lynch argued. Plants are still moving overseas, he quotes various economists and business people, adding that tax legislation “fails to eliminate long-standing incentives for companies to move overseas and, in some cases, may even increase them.”

Clearly, ending the

drift of companies, jobs and company resources to other nations has been a

years-long theme for Trump. The tax changes being enacted now drop tax rates

for corporations from 35% on paper to 21%, though most companies do not pay the

full 35%. Average corporate rates are more in the 26%-28% range.

In addition, the

government is giving companies who moved overseas the chance to return

assets—perhaps as much as $2-3 trillion—to the U.S. at about an average of 15%

in taxes. In the future, that figure could be closer to 10%, based on a minimum

tax on overseas income above a certain level.

The provision is billed as a way to discourage the movement of jobs and profit overseas. But the fine print of the new global minimum tax would make the problem worse, the Post reported.

The provision is billed as a way to discourage the movement of jobs and profit overseas. But the fine print of the new global minimum tax would make the problem worse, the Post reported.

The tax bill could

have been written with triggers in it that offered specific, tiered tax

incentives only to companies that did move back, for example, or who committed

now to creating jobs or investing in plant and processes.

This is complicated,

but not beyond understanding.

As the analysis outlined,

a corporation would pay that global minimum tax only on profit above a

“routine” rate of return on the tangible assets—such as factories—it has

overseas.

So, the more equipment a corporation has in other countries, the more tax-free income it can earn.

As a result, the analysis reflected, a U.S. corporation that builds a $100 million plant in another country and makes a foreign profit of $20 million would pay roughly $1 million in tax versus $4 million on the same profit if earned in the United States.

The minimum tax would be calculated on a global average rather than for individual countries where a corporation operates. A U.S. multinational could lower its tax bill by shifting profit from U.S. locations to tax havens such as the Cayman Islands.

So, the more equipment a corporation has in other countries, the more tax-free income it can earn.

As a result, the analysis reflected, a U.S. corporation that builds a $100 million plant in another country and makes a foreign profit of $20 million would pay roughly $1 million in tax versus $4 million on the same profit if earned in the United States.

The minimum tax would be calculated on a global average rather than for individual countries where a corporation operates. A U.S. multinational could lower its tax bill by shifting profit from U.S. locations to tax havens such as the Cayman Islands.

And while taxes

represent a cost, they are far dwarfed by the price of labor in any

manufacturing process.

Now, the basic tool

that Trump has been using has been to warn companies that if they move overseas

to offer cheaper wages, he and we will tax any products that these companies

try to sell in the United States, a tariff of sorts.

However, the complication is that, increasingly, overseas companies are making most components overseas and doing some assembly in the United States, making it difficult to say exactly where products are made.

However, the complication is that, increasingly, overseas companies are making most components overseas and doing some assembly in the United States, making it difficult to say exactly where products are made.

Still, the analysis

cited Labor Department information that companies such as Wells Fargo,

Microsoft and Caterpillar have announced plans to shift work overseas.

Companies such as Apple and Microsoft, have avoided U.S. taxes by formally assigning the intellectual properties behind innovative products—and the profit that comes from them—to foreign jurisdictions.

Companies such as Apple and Microsoft, have avoided U.S. taxes by formally assigning the intellectual properties behind innovative products—and the profit that comes from them—to foreign jurisdictions.

So, the question must

be asked: Are the policies we are undertaking actually bringing companies back

or making the problem worse? Will the president’s brags about the effects of

the tax bill on corporations actually work? Will tax policy and immigration

policies in tandem actually encourage tech companies to set up more offshore

facilities for code creation?

Market logic says

companies are likely to continue to move elements overseas if it is to their

advantage.

The incentive of 21% tax rates is good when compared with higher rates, but not so good if you are in a lower site overseas, subject to average global minimum taxes.

I have written previously about Apple, for example, which moved certain paper operations to Ireland, then to the Isle of Jersey, where they pay no tax on their quarter-trillion-dollar profits.

The incentive of 21% tax rates is good when compared with higher rates, but not so good if you are in a lower site overseas, subject to average global minimum taxes.

I have written previously about Apple, for example, which moved certain paper operations to Ireland, then to the Isle of Jersey, where they pay no tax on their quarter-trillion-dollar profits.

The numbers that

result from all this are pretty staggering. In 2008, the most recent year

available according to a published analysis, U.S. companies’ foreign units

booked nearly $77 billion in profit in Ireland, one of Europe’s smallest

countries.

And the $938 billion in profit reported by foreign subsidiaries of U.S. companies was more than triple what it had been for 2000.

While it is difficult to determine how many jobs have moved offshore since 2001, it is estimated between 750,000 and 3 million. Total manufacturing employment in the United States is 12.5 million, almost exactly what it was in 1941.

And the $938 billion in profit reported by foreign subsidiaries of U.S. companies was more than triple what it had been for 2000.

While it is difficult to determine how many jobs have moved offshore since 2001, it is estimated between 750,000 and 3 million. Total manufacturing employment in the United States is 12.5 million, almost exactly what it was in 1941.

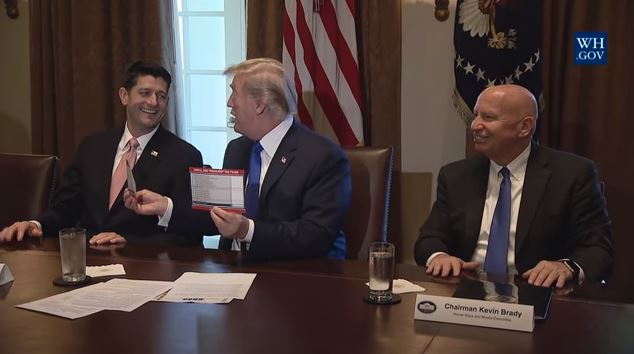

The point is, once

again, that we have to look carefully at those statements of braggadocio from

the president and Republican authors of the tax bill.

On paper, at least, on our behalf, the government has accepted the argument, specious or not, that corporate tax cuts will result in more jobs and bring companies and jobs home to the United States.

It seems to be a corporate Tinkerbell belief system—clap if you believe.

On paper, at least, on our behalf, the government has accepted the argument, specious or not, that corporate tax cuts will result in more jobs and bring companies and jobs home to the United States.

It seems to be a corporate Tinkerbell belief system—clap if you believe.

The market forces may

say otherwise.

We can only be sure

that American tax policy may make corporations great again.