Resisting the Trump Organization

Business Model

By Phil Mattera for the Dirt Diggers Digest

A recent 60 Minutes episode provided

further evidence of how the pharmaceutical industry successfully pressured

federal regulators to allow excessive prescribing of powerful opioids, paving

the way for the ongoing epidemic of fatal overdoses.

A recent 60 Minutes episode provided

further evidence of how the pharmaceutical industry successfully pressured

federal regulators to allow excessive prescribing of powerful opioids, paving

the way for the ongoing epidemic of fatal overdoses.

In recent days there have been

reports that Purdue Pharma, the company at the center of the crisis, is

planning a bankruptcy filing to reduce the risk from the 1,600 lawsuits that

have been brought against the company.

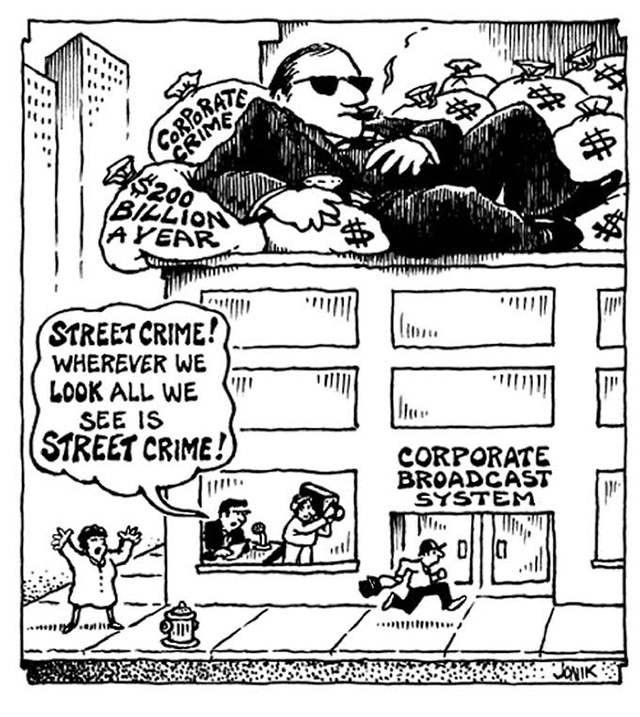

These developments illustrate how

the main structures that are supposed to deter corporate misconduct –

government regulation and the civil justice system – are not up to the task.

Despite the endless complaints from

the business world about rules and lawsuits, there are in fact few meaningful

limits on corporate behavior.

Despite years of evidence showing

that many industries dominate and neutralize the government agencies that are

supposed to oversee them, the proponents of deregulation all too often carry

the day.

The current presidential administration has embraced that ideology whole-heartedly and has even tried to promote the idea that relaxed regulation benefits not only corporations but workers and consumers.

Yet there’s growing evidence that what interests Trump most is using regulatory powers to punish his political enemies and reward his friends.

That’s the message of new reporting by Jane Mayer in The New Yorker that

Trump personally urged the Justice Department to try to block AT&T’s

acquisition of Time Warner, apparently thinking that by sinking the deal he

would harm Time Warner’s CNN unit and boost its rival, the exceedingly

Trump-friendly Fox News.

There were earlier reports that

Trump’s criticism of Amazon’s contract with the U.S. Postal Service was an

indirect assault on the Washington Post, owned by Amazon CEO Jeff

Bezos.

Aside from being an obvious abuse of

presidential power, this approach is no better than a “principled” deregulatory

stance.

While Trump may occasionally direct

his ire against companies that deserve to be punished, the vast majority of

miscreants will end up being let off the hook.

Many of the same business apologists

who criticize regulation also fulminate against lawsuits.

These tort reformers don’t explain

how else we are supposed to deal with rogue corporations. Nor do they

acknowledge that such companies can greatly limit their exposure with the help

of the bankruptcy court.

Purdue Pharma would be far from the

first corporation to use Chapter 11 in this way.

The filing would not shield the

company entirely, but it would greatly reduce its financial liability and make

it easier to survive the process.

Moreover, the Wall Street

Journal pointed out that “Purdue’s assets may not be enough to resolve the

company’s potential liability, in part because most of its profits had been

regularly transferred to members of the company’s controlling family, the

Sacklers.”

In other words, much of the

corporation’s ill-gotten gains are already out of the reach of the plaintiffs.

When restraints are weak or non-existent, it is more likely that companies will adopt the business model of the Trump Organization, which appears to be that of breaking every rule and cheating everyone it can.

Our challenge is to find new ways to

fight back.