Companies claim constitutional right to cheat

By Philip Mattera, director of the Corporate Research Project in the Dirt Diggers Digest

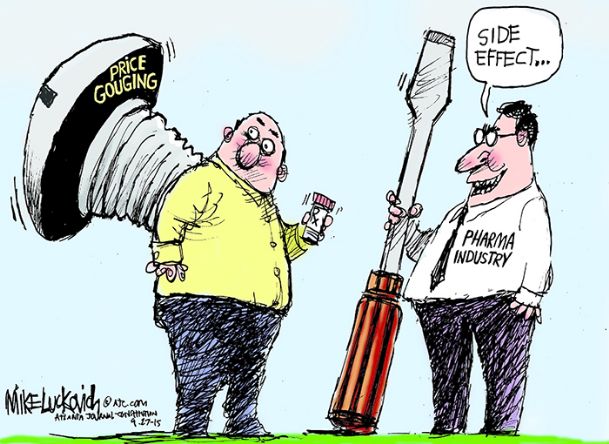

Big Pharma has been fleecing its U.S. customers for so long, the industry came to regard it as a right. That arrangement started to come to an end last year, at least as far as one large customer, the federal government, is concerned.

The Inflation Reduction Act included a provision

empowering Medicare to begin negotiating some drug prices in 2026.

One pharmaceutical giant has decided to fight to preserve the gravy train. Merck just filed a lawsuit challenging the law, claiming that the obligation to negotiate is an infringement of its constitutional rights.

The company argues that its Fifth Amendment protection against government

seizure of private property would be violated. It also says that having to sign

an agreement reached after negotiation would trample its First Amendment free

speech rights.

The Fifth Amendment takings argument is a favorite position of conservatives in opposing all manner of government regulation, but the obligation to negotiate prices is not regulation.

It is actually a free market correction to the absurd restrictions that have long existed on the ability of Medicare to bring drug prices back down to earth. The First Amendment argument is laughable.

It is not surprising that Merck would try its chances in court once its lobbying efforts against the law failed. The company has a lot at stake. It rakes in several billion dollars of revenue each year from the sale of diabetes and cancer medications through Medicare plans.

Even if its

lawsuit initially fails, Merck presumably hopes it will receive a more

sympathetic hearing if the case reaches the corporate-friendly Supreme Court.

Freedom from having to negotiate with Medicare is not the only way in which Big Pharma has managed to evade competition.

As I described

in a report on

antitrust cases published in April, drug companies have repeatedly been caught

engaging in illegal schemes to block the introduction of lower-cost generic

alternatives to their brand-name medications. Since 2000 the industry has paid

a total of $10 billion in fines and settlements in these pay-to-delay cases.

Merck is one of those firms implicated in this practice.

For example, in 2017 it agreed to pay $60 million to

settle class action litigation alleging that its subsidiary Schering-Plough had

taken improper actions to block the introduction of a generic version of K-

Dur, which is used to treat potassium deficiencies.

Along with anti-competitive behavior, the pharmaceutical industry has a record of questionable practices in its dealings with the federal government. Merck alone has paid nearly $800 million in fines and settlements relating to alleged violations of the False Claims Act.

For example, in 2008 it agreed to pay $650 million to

resolve allegations that it failed to pay proper rebates to Medicaid and other

government health care programs and paid illegal remuneration to health care

providers to induce them to prescribe the company’s products.

These forms of misconduct, along with the immunity from

having to negotiate prices with Medicare, have for too long given the drug

companies the upper hand in their dealings with the federal government. The

Inflation Reduction Act takes an important first step toward correcting that

situation. It would be a shame if the courts turn back the clock.

Note: Corporate Crime Reporter reports that

the Justice Department has quietly introduced a search engine covering its

actions against business entities and individuals. As of this writing,

the Corporate Crime

Case Database contains only 11 entries but more is promised.