By FRANK CARINI/ecoRI News staff

The Federal Emergency Management Agency (FEMA) flood maps are often criticized and called confusing, and they’re also way wrong, according to one of Rhode Island’s foremost climate-change experts.

Grover Fugate, executive

director of Rhode Island’s Coastal Resources Management Council (CRMC), called

the maps “insanity” during a recent interview with ecoRI News.

FEMA’s maps represent the federal government’s best estimates of floodplains, and they hold much power. They are the standard in determining building codes and setting insurance coverage.

When property isn’t included on these maps, owners aren’t required to buy flood insurance — often creating a false sense of security.

These maps, however, are

typically out of date and based on historical flooding and past development.

They don’t anticipate climate-change trends, they often ignore rising sea

levels, and they don’t account for rapidly expanding development in flood-prone

suburban regions, according to critics.

“Texas developers in

Galveston are ignoring FEMA flood maps and building more resilient structures,”

Fugate said. “FEMA maps in some incidences are 10 feet off. A three-foot wave

can take a building out. These maps don’t account for offshore wave

activity."

By the end of this century,

Rhode Island, like much of the East Coast, will be particularly susceptible to

the impacts of climate change and sea-level rise, and one of the sectors to

feel those impacts acutely will be the real-estate industry.

“We keep building to

standards today that will be obsolete and damaging in the future,” Fugate said.

“We need to build to future conditions, not to today’s conditions. We should be

building to a standard that is higher than today’s standard. But there’s a lot

of inertia to build the old way.”

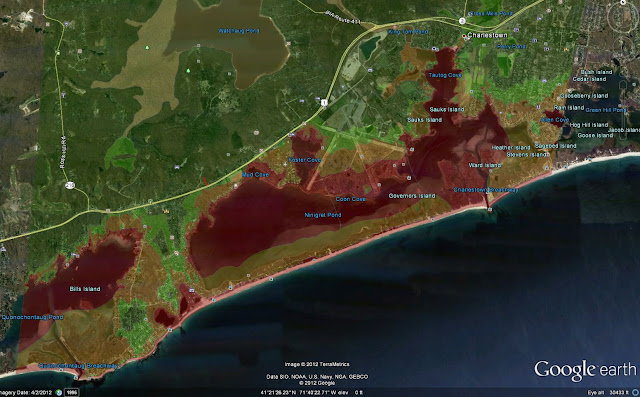

To counter FEMA’s unreliable

data, the Coastal Environmental Risk Index (CERI),

which expands on what the computer mapping program STORMTOOLS already

built, was created to provide the Ocean State with more detailed and accurate

flood mapping. The project was led by Fugate and Malcolm Spaulding, professor

emeritus of ocean engineering at the University of Rhode Island.

“STORMTOOLS and CERI go down

to the neighborhood level,” Fugate said. “They help us make land-use decisions

at the local level, down to individual properties.”

Fugate noted that FEMA maps

are fundamentally inaccurate because the geographic points they rely on, called

transects, are too widely spaced. The CERI maps, he said, are based on many

more transects and data points.

He also noted that federal

flood maps underestimate how more frequent and intense storms will impact the

state’s coastal dunes, most notably in southern Rhode Island. Dunes don’t offer

as much protection as FEMA would lead one to believe, Fugate said.

“Most dunes disappear a few

hours into a storm,” he said. “There’s only a few in the state that can handle

a hurricane and stay.”

The Ocean State’s erosion

rate is projected to double by 2065, and increase by two-and-a-half by 2100,

according to CRMC. The Matunuck area of South Kingstown, for instance,

currently averages about 4 feet of erosion annually.

Fugate noted that Rhode

Island hasn’t experienced a major hurricane since 1954 and that the most recent

maps developed by FEMA underestimate the present risk to coastal properties

from storm surge, erosion, and flooding, by reducing flood elevations and not

recognizing the impacts of sea-level rise during the lifetime of structures.

He said STORMTOOLS and CERI

were created so Rhode Island no longer had to wait until a storm hit to see

what the damage would be. These geographic information system-based mapping

tools provide coastal flooding, sea-level rise, and storm-event scenarios, and

project storm surge and wave action.

If a structure is in a

high-risk flood zone, a buyer must get flood insurance in order to get a

mortgage. For owners of existing structures within flood zones, taking out a

line of credit, obtaining a reverse mortgage, or acquiring any federally

attached loan requires the borrower to buy flood insurance.

For property owners looking

to build any structure within the special flood hazard area requires flood

insurance if a mortgage is needed, and new construction has to meet the most

recent building codes, according to the Rhode Island Shoreline Change Special Area

Management Plan (Beach SAMP).

A 2017 assessment from the

National Oceanic and Atmospheric Administration projects 9.6 feet of sea-level

rise in Rhode Island by 2100. The Ocean State has about 420 miles of coastline,

and nearly $4.5 billion worth of property lies on land less than 5 feet above

the high-tide line.