Cutting

RI budget will hurt the economy, delay recovery says Economic Progress

Institute

|

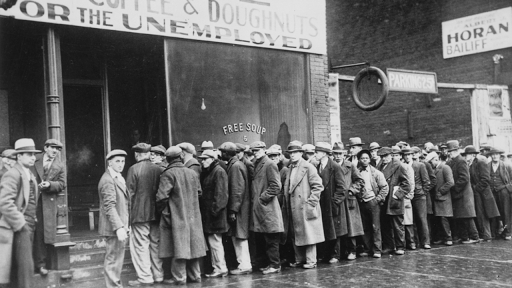

| The last time we were this bad off, President Herbert Hoover applied fiscal restraint to head off the Great Depression. He made things worse. Then President Franklin Roosevelt stepped in and used government spending - especially jobs creation - to work out way out. |

“Contrary to claims that cutting spending will prove an absolute necessity, policymakers have options for avoiding destructive cuts — cuts that will disproportionately harm Black and Latinx households, which have been hit hardest by both the public health and financial crises of COVID-19,” writes the EPI in their report. “Furthermore, evidence from the Great Recession a decade ago clearly shows that where states made severe cuts, the economy slowed and emergence from recession took longer.“

The

report contains several ideas for covering the estimated $617.7M shortfall for

fiscal year 2021.

- Raise taxes on the highest earners: “A modest increase on the marginal income tax rate for the top 1% of taxpayers (who often maintain considerable wealth in addition to high earnings), would raise valuable revenue from those most able to afford it (and those who are much more likely to be able to work remotely and keep safer from COVID-19 infection, while others must take greater risks). Legislation introduced by Senator William Conley (Democrat, District 18, East Providence, Pawtucket) and Representative Karen Alzate (Democrat, District 60, Pawtucket) would raise an estimated $128.2 million by increasing the top marginal personal income tax rate from 5.99% to 8.99% on taxable income above $475,000.”

- Rainy Day Fund: Contrary to Speaker Nicholas Mattiello’s idea that the state should immediately start to rebuild and even increase the rainy day fund, EPI points out that “[t]he rainy day continues, and these revenues are needed for more immediate and urgent purposes.” There will $200M in the rainy day fund next year. Some of that could and should be used to cover the shortfall.

- The Car Tax: The state should also not continue the phaseout on the car tax, said the EPI. The cost of the car tax phase out will be over $100M in 2021. “Furthermore, much of the benefit of the phase out has already gone to those individuals who needed it most,” writes EPI. “For example, a car valued at $3,000 or less is now fully exempted from the tax. Anyone with a car valued at $10,000 now pays no more than $200 per year. As the phase out continues, the benefits will accrue more and more to the wealthiest Rhode Islanders, to those with the most cars and the most expensive cars. In addition, individuals who do not own cars have experienced no tax relief and will never receive this tax relief, while paying sales and income taxes that support the state payments to local governments.”

- Borrowing: “Borrowing at today’s low rates provides the opportunity to invest wisely in people, jobs and retraining, and education, to keep the local economy moving and to build the sort of infrastructure that makes Rhode Island a wonderful place to live and to grow businesses,” writes EPI, offering several options: designating special entities to borrow for specific purposes; selling bonds to the new Municipal Liquidity Facility created by the Federal Reserve Bank to assist municipalities and states; selling bonds secured by future expected revenue (as is sometimes done, for example, with bridge and highway tolls); and issuing “Human Capital Bonds” as investments in education and possibly other areas

- Federal Aid: The state will receive an estimated $83.2M in federal matching Medicaid dollars next year, and more if the Covid emergency declaration continues. Further, there is a good chance of federal aid to the state at least equal to the $1.25B in aid provided to Rhode Island under the CARES Act.

The

last paragraphs of the EPI report are particularly important for lawmakers to

understand:

“That austerity and stimulus produce very different results is not

simply a matter of common sense or theory. There is strong evidence, including

from the Great Recession of a decade ago. For example, a recent

analysis from the Economic Policy Institute demonstrates that states which

maintained their public employment levels during the Great Recession

experienced on average a return of private employment to pre-recession levels a

year and a half more quickly than states, like Rhode Island, that embraced a more

austerity-focused mindset and made deep cuts. More generally, if state and

local governments had not functioned as “relentless anti-stimulus machines”

during the years following the Great Recession and had instead followed the

approach taken with the recession of the early 1980s, recovery would have

arrived four years earlier, in 2013 instead of 2017. In light of this

experience, cutting jobs, services, and spending would prove an irresponsible

move.

“It is critical that Rhode Island does not repeat the mistakes of

the last downturn. The options presented here could preserve, replace, or bring

in hundreds of millions of dollars in revenue, enough to cover much, if not

all, of the projected shortfall, even without a new round of federal aid. We

need to make investments that keep people working and spending, so that money

continues to circulate in the local economy and strengthen and quicken Rhode

Island’s emergence from a recession and its recovery. No single method will

make up for the entire revenue shortfall, but the four options discussed here

could together make a huge and pivotal difference.“

Steve Ahlquist

is a frontline reporter in Rhode Island. He has covered human

rights, social justice, progressive politics and environmental news for nearly

a decade. atomicsteve@gmail.com

Can you help us?

Funding

for UpRiseRI reporting relies entirely on the generosity of readers like you. Our

independence allows us to write stories that hold RI state and local government

officials accountable. All of our stories are free and available to everyone.

But your support is essential to keeping Steve and Will on the beat, covering

the costs of reporting many stories in a single day. If you are able to, please support Uprise RI. Every contribution, big or

small is so valuable to us. You provide the motivation and financial support to

keep doing what we do. Thank you.