Two senators want cryptocurrencies as retirement savings

By ERIK SHERMAN

Sometimes, an interview can shine a light on the political system and leave viewers scratching their heads if not reaching for a bottle of aspirin.

Senators Kirsten Gillibrand (D-NY) and Cynthia Lummis (R-WY)

appeared on camera with Bloomberg Technology discussing their proposed

cryptocurrencies legislation. They said there’s a need for “transparency and

accountability” as well as “consumer protections” and legal predictability for

industry players.

And yet, some of the statements by these senators were astounding

in their ignorance and presumption.

For example, the interviewer asked about the black market and

using crypto to finance illegal transactions. Gillibrand’s Response: “I’m on

the Intelligence Committee, and I can tell you that the interesting nature of

blockchain technology is that it’s a hundred percent transparent, so if you

want to trace who bought or sold something through cryptocurrency, you can do

that pretty easily.”

Say what, Senator?

Many people transacting using cryptocurrency do so through

anonymous identities on the Internet. Since the inception of Bitcoin, no one

has been able to identify its inventor.

People have stolen billions in cryptocurrencies without being

caught, which evidently would be news to New York’s junior senator.

It’s not impossible to trace activity. Regulatory and law

enforcement agencies have managed to do it. But the thought that every buyer

and seller is easily identifiable and the proceeds traceable That’s fantasy.

Even if every transaction can, in theory, be tied to all

participating parties, the idea that the underlying technology is inherently

safe is ludicrous. Current events show otherwise.

Senators Push Crypto

Bloomberg Technology wasn’t the only media stop for the two

senators. They were making the rounds, including CNBC’s Squawk Box with Andrew Ross Sorkin hosting.

Sorkin asked the pair about the news that Fidelity, “the largest 401(k) manager

in the country,” plans to offer Bitcoin investments in retirement accounts of

employers allowed that option.

For good reasons, the Department of Labor has come out strongly

against crypto in retirement savings plans. As I noted at Forbes.com, “Pushing crypto investments onto

people, the vast majority of whom would have a hard time even knowing what

the total of fees charged to their accounts are, should be beyond any

reasonable professional ethics in the financial industry. This is asking people

to potentially take a deep and unpleasant bath and undermine value they’ve

built up over many years and will need in retirement.”

Said Senator Lummis: “I think the Labor Department’s wrong. I

think it’s a wonderful idea, it should be part of a diversified asset

allocation, and it should be on the end of the spectrum of a store of value.”

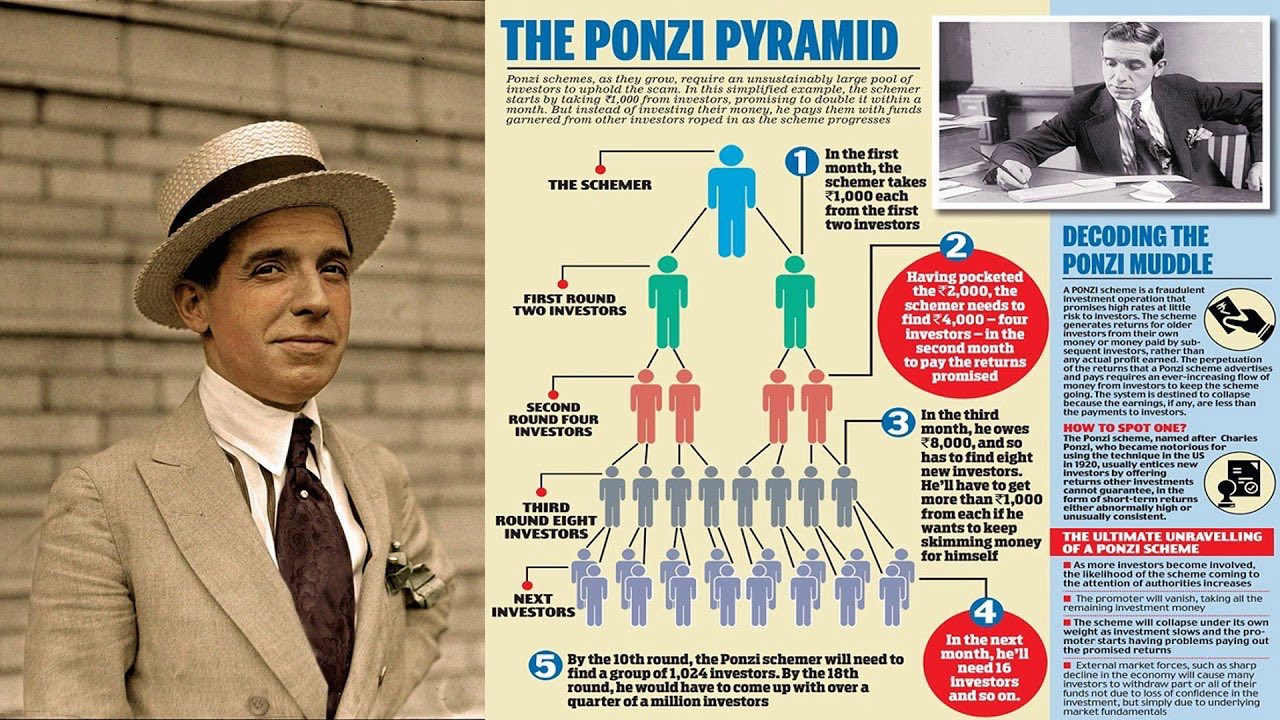

Greater Fool

That’s even worse than pretending everything on a blockchain is

perfectly transparent. Some investment professionals I know call putting money

into cryptocurrency speculation, not investment. There’s nothing behind crypto

other than how many people will keep buying at higher prices, otherwise known

as the greater fool theory. So when you hold over-valued

assets, you only make money by selling to a bigger fool than yourself.

Curiously, some crypto advocates have complained in the past

that the U.S. dollar isn’t backed by gold. Crypto is backed by exactly nothing,

while our federal government’s full faith and credit backs the dollar.

If you want a store of value, look at fiat currencies backed by

major governments—for example the U.S. dollar, Euro, Japanese Yen, and English

Pound. Their values fluctuate but do not drop by massive amounts overnight as

with crypto when the smart money converts to reliable currencies.

Maybe Lummis believes what she’s saying. Her state of Wyoming is

home to lots of cryptocurrency activity. But, as Judd Legum pointed out in his newsletter, Popular

Information, Lummis bought between $50,000 and $100,000 of Bitcoin on August

17, 2021. (DCReport checked Lummis’ financial disclosure statements to verify

those purchases.)

“At the time of her purchase, a Bitcoin was worth $44,671.

Today, a Bitcoin is worth $27,978.70,” Legum wrote. That’s a 37% decline in 10

months.

Self Interest?

So why would Senator Lummis want others to put their retirement

savings at such a risk of catastrophic loss, a loss much worse than the drop in

broad stock indexes? Could self-interest play a role?

“If a portion of the $11 trillion invested in 401(k) accounts

were diverted into Bitcoin, it could significantly drive up the price,” Legum

wrote. “Lummis previously said that she has been investing in Bitcoin since

2013 and her current holdings are valued between $150,000 and $350,000.”

Think of it as a bailout by making foolish, rather than prudent,

purchases in retirement savings plans like 401(k) plans.

Legum wrote that in June. As of July 8, 2022, Bitcoin had fallen

further to $21,688.70. For the junior senator from Wyoming, that’s a loss of

more than the cash she spent last August buying Bitcoin.

At least Lummis bought Bitcoin rather than one of the even

dodgier cryptocurrencies. There are more than 19,000 of them, many of which

appear to be pure scams.

Consider some of the biggest disasters in cryptocurrency.

According to CNBC and the Bangkok Post, the big cryptocurrency investment firm

Voyager Digital went belly up after hedge fund Three Arrow Capital

defaulted on a $670 million loan in June.

A delivery man

Then there’s Jacob Willette, a 40-year-old DoorDash delivery

driver in Arizona whose life savings of $120,000 was held by crypto lender

Celsius, according to The New York Times. When

cryptocurrencies started to slide, Willette wanted to convert his holdings back

to good old American cash.. He only got “evasive answers” and, so far, none of

his money.

Again, Senator Lummis may believe what she’s saying. Although,

as I documented a few years ago at IBTimes, politicians often play with financially self-dealing decks.

Their holdings affect policy decisions. The research found a “statistically

significant association between a legislator’s relevant investment and then their

roll call [vote].” The data is not a slam-dunk proving self-interested votes,

but it certainly is troubling.

Even with inside information, people in Congress often show

themselves to be anything but financially savvy investors or speculators.

A 2015 study by researchers at the London School of Economics

and the Massachusetts Institute of Technology analyzed stock trading records of

members of Congress. It didn’t show any benefit from what they knew. The study

found that the average member “would have earned higher returns in a passive

index fund.”

Instead of buying individual stocks, even with inside

information, investing in a mutual fund that parallels something like the

S&P 500 or the Dow Industrial Average would have been more lucrative. In

other words, opening an account at a place like Vanguard and not trying to

direct things for their advantage is superior.

If you want advice on how to fix your car, see a mechanic, not a

financial advisor. And if you want financial advice, go back to that advisor, not

someone at Congress who may not have an ax to grind or may be trying to rescue

their foolish use of their money because when it comes to investing they may

not have a clue.

Erik Sherman is an independent journalist and author who primarily covers business, economics, finance, technology, politics, and legal/regulatory, elegantly expressing the complex and often incorporating data analysis.