Highest per capita administrative cost in the state

By Will Collette

Our newly sworn-in, non-CCA Town Council majority has made a close review of Charlestown’s finances and fiscal management its top priority.

They may be aided in that effort by a new

report released by the conservative RI Public Expenditure Council that

compares the cost of municipal government in very sharp detail. While I dislike

RIPEC’s right-wing slant and animus toward labor unions, I do trust their

ability to collect and present the data.

Their report is loaded with useful charts and graphs that

allow you to compare the 39 Rhode Island cities and towns across a wide range

of categories.

During the CCA’s long reign over Charlestown, their constant

refrain was to talk about how low Charlestown’s tax rate is. It is that, but

only because the bloated values of waterfront property owned by non-residents

give us a very large tax base. That large tax base has paid for the CCA’s

spendthrift habits.

RIPEC data shows Charlestown’s taxpayers pay $1,818 each for

non-education municipal services, well above the state per capita cost average

of $1,593. The lowest per capita cost is $623 in Exeter, perhaps due to their

unwillingness to pay for police or fire departments. The highest per capita is

Newport at $2,762. [Figure 4, pg. 13]

RIPEC explains why Charlestown, Newport and other

communities have such high costs in a footnote on page 14:

Those municipalities are: New Shoreham, Little Compton, Jamestown, Narragansett, Charlestown, Newport, and Westerly. Several of the state’s municipalities with the greatest property wealth may have greater per capita spending because they attract a number of non-full-time residents and/or visitors who are not counted in the U.S. Census but who nevertheless contribute to demand for local government services. Subsections on police and fire below contain a more detailed discussion of quantifying demand for local services. U.S. Census Bureau, 2020 Census Residence Criteria and Residence Situations.

This fact has long been evident and was the reasoning behind

a 2011 push by Charlestown Democrats for a homestead property tax credit to

offset the impact of the cost of services to non-residents. The

CCA mobilized what I called the “Riot of the Rich” to attack and destroy the

Democrats’ proposal.

But I think it’s time to rethink that decision. Note that Newport

will be the latest of our peer communities to institute a tax credit for

year-round residents with applications available on January 1. North

Kingstown adopted a homestead credit last year and Narragansett a couple of

years before that.

Other data in the RIPEC report made me twitch. I can’t

explain the reasons why a number of Charlestown cost items are so high, other

than to rely on RIPEC’s belief, above, that our high number of summer people

cause them.

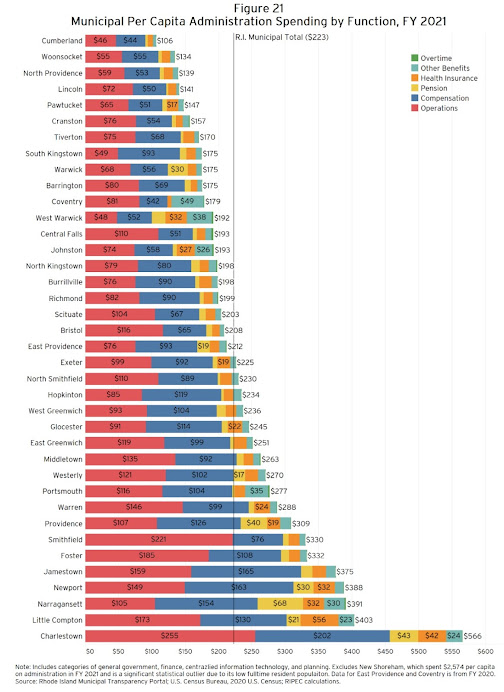

Take, for example, Charlestown’s cost for town

administration. Our administration cost is $566 per resident, compared to the

state municipal average of $223 and that of Cumberland, the lowest, at $106 per

capita. That makes Charlestown the highest municipal spender per capita

among Rhode Island cities and towns.

We rank first in two of the largest categories within

administration: compensation at $202 per capita and operations at $255 per

capita. Overall, there’s a big spread between Charlestown’s administrative

costs and all other cities and towns that exposes issues that should be rigorously

reviewed. [Figure 21, pg. 35, below]

Maybe the higher cost is due to the amount of staff time

devoted to blacking

out records requested by citizens under the state’s Access to Public Records

Act.

Charlestown's administrative costs are at the bottom of the chart meaning the highest in the state

Charlestown is ranked in second place for the highest per

capita spending on parks, recreation, and natural resources at $115 per

capita, edged out by Jamestown's $122. The state’s municipal average is $47.

The stingiest is Richmond at only $2 per capita. [Figure 28, pg. 45]

Obviously, the CCA’s frenzied purchases of vacant land for

open space accounts for our high relative cost. And that’s without factoring in

how each purchase subtracts the property tax the former owners were paying.

Our per capita spending on public works is fifth highest

in the state at $366. Our neighbor South Kingstown is the lowest in the

state at $90 per capita. The state average is $193.

This seems to be another cost item greatly affected by our

summer people. The infrastructure that serves them during the summer must be

maintained year-round. However, that doesn’t explain the extreme disparity

between our costs and South Kingstown’s since they also have lots of summer

people.

Charlestown’s public works budget doesn’t include water,

sewers and in many cases, road maintenance within many subdivisions where homeowner

associations are responsible for those costs. By contrast, South Kingstown does

provide these services but at a much lower per capita cost burden.

Police protection costs Charlestown $429 per capita, the 7th

highest in the state. We also pay the 4th highest police salaries in

the state. Including benefits, the Charlestown police per capita average is

$89,945. Westerly and Newport pay slightly more. The lowest in the state is

Foster at $61,587. Block Island pays the highest at $132,933.

For calls for service handled by each officer, Charlestown

ranks 4th at 811.7 per officer. Newport is the highest at 1,129.7

per officer. [Figure 11, pg. 23]

We don’t figure into RIPEC’s analysis of fire-fighting costs

since we don’t have a professional fire department. That’s a major factor in

our CCA-heralded low tax rate.

I have no issues with the town’s rank-and-file staff nor

with their unions. I’m OK with our high police costs since RIPEC’s data also

shows they work hard for their money.

I do believe RIPEC’s data flags some issues that deserve the

new Council majority’s attention to ensure we are getting value for our tax

dollars. Our high costs for administration, public works, plus our spending

spree to buy more open space deserve close attention.

While I appreciate our low tax rate, it seems obvious from

the RIPEC data that this rate could and probably should be a lot lower. We’ve

raised this issue before in articles on the CCA’s $3 million “oopsie” and the

town’s failure to use the correct number of work days per year to calculate the

town’s payroll.

Finally, I believe RIPEC has unintentionally strengthened

the case for Charlestown to enact a Homestead property tax credit given the

disproportionate impact of absentee property owners on municipal costs. As the

new Council reviews the issue of fair taxation, a Charlestown Homestead credit

should be on the table.