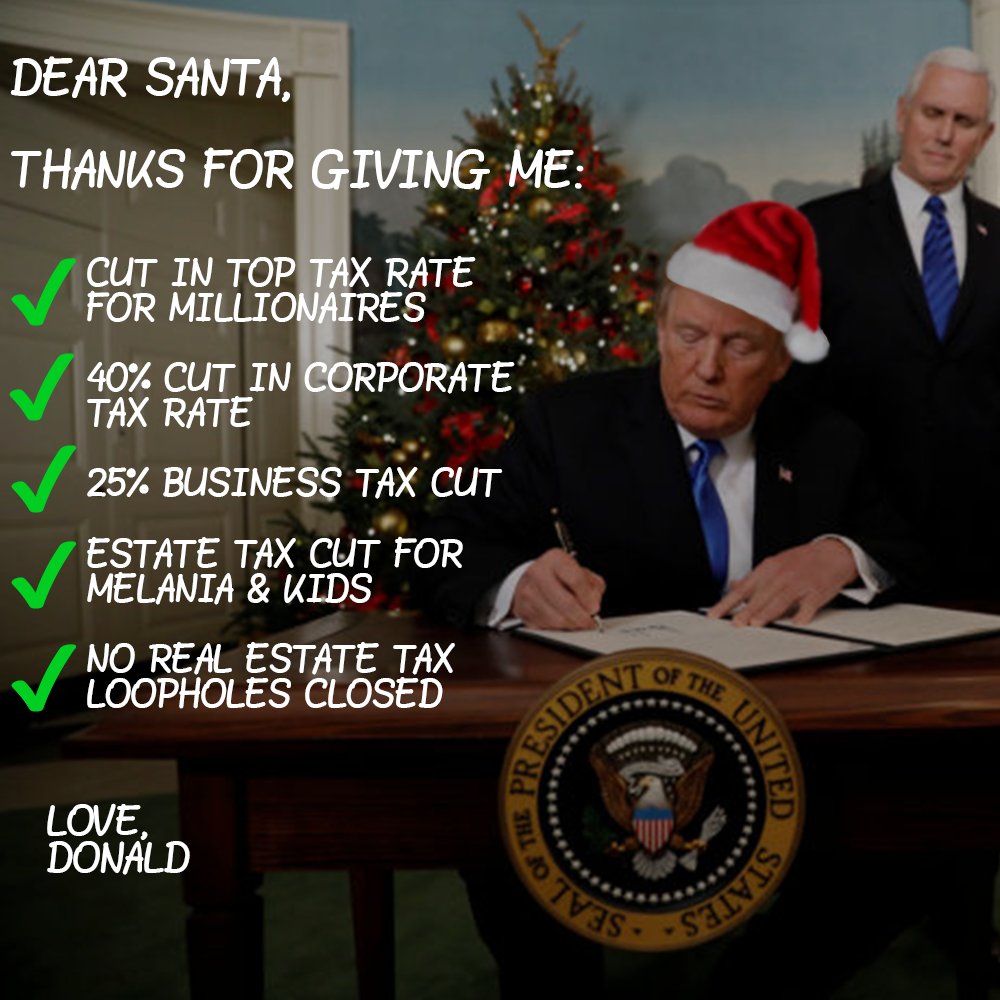

Study Details How President Will Profit Off

GOP Tax Bill

President Donald Trump

has repeatedly described the Republican tax bill he signed into law on Friday

as "an incredible Christmas gift" to low-income and middle class

Americans—despite the numerous analyses showing that the legislation will ultimately raise

taxes on millions in the middle class.

President Donald Trump

has repeatedly described the Republican tax bill he signed into law on Friday

as "an incredible Christmas gift" to low-income and middle class

Americans—despite the numerous analyses showing that the legislation will ultimately raise

taxes on millions in the middle class.

The president hasn't,

however, called the tax bill a massive "check to himself."

But a new study (pdf)

published on Friday by Americans for Tax Fairness (ATF) demonstrates that this

would, in numerous ways, be a more accurate description of the $1.5 trillion

plan.

While it is impossible

to determine precisely how much Trump will benefit from the GOP's legislation given

that he has persistently refused to release his tax returns, ATF finds

that Trump could save "at least $11 million a year and perhaps as much as

$22 million," thanks to several central elements of the tax plan (as well

as some of its under-discussed components).

The massive cut to the

corporate tax rate—which Trump has openly described as "probably the

biggest factor" in the bill—will also be a huge boon for the

president, given that he "owns millions of dollars in individual stocks

and mutual funds."

Other prominent

aspects of the bill that will benefit Trump include the plan's favorable

treatment of so-called pass-through business income as well as its estate tax

exemption, which "doubles the amount excluded from the tax, from roughly

$5.5 million for individuals and $11 million for couples to about $11 million

and $22 million."

ATF goes on to examine

the bill's favorable treatment of the real estate industry, which "will

continue to enjoy some of the biggest loopholes in the tax code under the

Trump-GOP tax law."

Where the GOP plan

closes loopholes, ATF notes, it makes exceptions for the real estate

business—where Trump made much of his fortune.

"When crafting

the measure at least two special exceptions were made for the real estate

industry when a loophole was closed," AFT notes:

"Like-Kind Exchanges (Section 1031

Exchanges): Capital gains taxes

are usually due when an asset is sold for more than it cost. But under current

law, investors in tangible items can indefinitely delay paying if they keep

reinvesting the proceeds in another item—what’s called a 'like-kind exchange.'

If these gains are continuously rolled over until the taxpayer dies, they are

never taxed at all. The Trump-GOP tax plan closes the like-kind-exchange

loophole for real property—except for

real estate investors such as Trump, who get to keep this handy way of avoiding

taxes on their gains.

Limiting Interest Deductions. The Trump-GOP plan required almost all

businesses to accept new limitations on their right to deduct interest payments

on their loans. All businesses, that is, except

for those involved in real estate investments, such as Donald Trump’s. He’s

called himself the 'king of debt'—some observers estimate his business loans

exceed $1 billion."

And despite

Trump's promise to

"eliminate tax breaks and complex loopholes taken advantage by the wealthy"—a

promise he claimed made his accountants go "crazy"—the GOP bill

leaves open a number of loopholes "enjoyed by real estate investors like Donald Trump," including:

Depreciation, which allows real estate investors to write off the costs of

property even as its market price rises, "cutting their taxes even as

their wealth grows";

Passive losses, which allow real estate professionals to use

"investments intended to lose money to reduce taxable income"; and

The at-risk rule, which allows investors like Trump "to

reap tax-saving losses from properties they bought mostly with borrowed

money."

Taken together, these

loopholes and tax cuts could net the president millions of dollars of extra

income per year—all while many middle class families see their taxes rise and

their health insurance vanish.