It’s not news that the 1% get off easy, but it still sucks. Here’s how to make Congress fix it.

By David Cay Johnston, DCReport

Editor-in-Chief

Now that we have a seasoned Washington hand in the White House working with a team of competent appointees and a plan to distribute coronavirus vaccines, we can begin to rebuild our economy.

But there is a major problem: stealth welfare for the rich.

In good conscience, the Biden administration can’t overlook

this hidden welfare system for wealthy people who neither need nor deserve

a handout. Congress lets this elite group scoop up welfare money by the

boatloads.

Raising tax rates on incomes above $400,000 and on corporate profits, as Biden pledged, will bring in revenue. It will make our tax system less unfair. That’s faint praise.

The plan misses the big money; our system of

upward redistribution, which I’ve spent decades documenting from the public

record.

The core problem: Not all income is verified equally nor taxed equally, if at all. The current tax system is has big holes that can be closed easily by tweaking existing law. In terms of drafting a law—that’s easy.

Getting the American people to demand it and overcome the influence of those

who benefit is another matter entirely.

Earn Now, Pay Taxes Later

The first hole allows corporations and partnerships to earn now

but pay income taxes by-and-by.

The second hole is income from legal sources that the IRS never knows about, especially in real estate and art. We’ll examine this second hole in a future DCReport article.

Unlike you and me, corporations and certain partnerships large

enough to afford sophisticated advice — and super-rich individuals who own and

control big businesses — get to earn now and pay much later.

This happens because Congress requires them to keep two sets of

books. If that sounds like the kind of organized crime schemes made famous by

Eliot Ness in pursuing Al Capone, you got it right. What should be a crime is

legal thanks to Congress.

The number for income tax that a big company like Amazon puts on its

financial statement line does not indicate taxes actually paid. It’s not like

your W-2 wage statement of taxes withheld from your paycheck, which are

promptly turned over to our Treasury. That line (see Item 6) just shows the tax

that the company may, someday, pay.

Hidden

in Plain Sight

The actual taxes paid in any given year may be less than zero as

a company collects refunds on past taxes. Many big companies including Amazon have

enjoyed a negative income tax in recent years. Matthew Gardner of the Institute on Taxation and

Economic Policy explains more here.

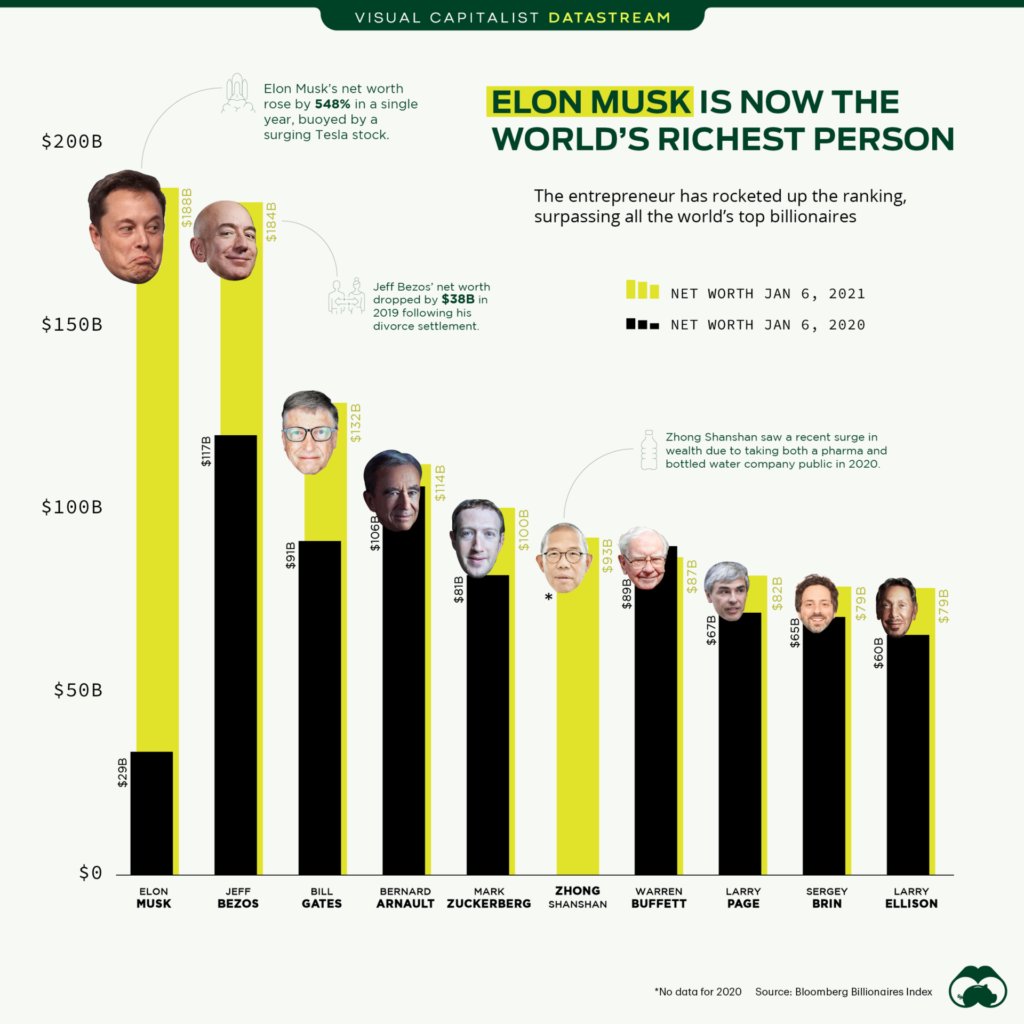

Source: Visual Capitalist

Taxes actually paid are disclosed, sort of, in a footnote to the

financial statements. But even that is misleading because our government’s

disclosure rules lack transparency and integrity.

And the taxes that should be paid are known only if the very best IRS tax auditors conduct examinations.

But under rules that Congress

enacted two decades ago, the IRS must notify companies in advance of what they

are looking for. The IRS auditors are not allowed to pursue anything else they

find, no matter how much money is at stake, unless they have clear evidence of

fraud. That’s official corruption.

Contrast this with Congress requiring your employer, pension plan, mutual fund, bank and stock brokerage to report how much money you collected.

Petty merchants have the total of their credit card payments

reported to prevent understating revenue. And it’s all automated, making

inexpensive the cost of ensuring that gross incomes are reported fully. The

system for making regular people pay taxes is almost perfect in its

effectiveness.

Taxes

as Profits

Complaints about the burden of taxes on the wealthiest among us

and corporations make the front pages in the evening network news frequently.

But you almost never hear that many of these complainers profit off our tax

system. That’s because through the modern alchemy of accounting and tax rules

they can convert the burden of taxes into a profit center.

The trick is to get a loan from Uncle Sam at 0% interest. Better

yet, take out a new loan every year and the amount of capital the taxpayers are

giving you to invest snowballs.

How do you apply for and qualify for these 0% interest loans?

That’s one of the best parts. You don’t. Congress hands them out automatically

under our accounting and tax rules. For simplicity, we will ignore inflation in

explaining this program of stealth welfare for the rich.

Don’t

Pay for 30 Years

Now please imagine our government sent you a letter today saying

you can keep all the taxes withheld from your 2020 paychecks for the next 30

years, but you must pay up at the end of 2050.

Now invest that money in a stock that pays no dividend and

increases in value at a modest 4% annual rate of return through 2050.

For each dollar of deferred tax, you will have $3.24 in 2050.

After paying the $1 tax you are left with $2.24. You’ll owe a 20% long-term

capital gains tax on that money. That leaves you with $1.79. You are richer

than if withholding took the tax in 2020.

If the investment you made grew at a 10% annual rate, which

wealthy individuals with sophisticated advisers should be able to achieve, the

riches that flow from tax deferral balloon. Each dollar of deferred tax becomes

$17.45. After paying both the deferred tax and the 20% levy on the capital gain

you walk away with $13.16.

See how tax deferral can make you rich? See how it enables

dynastic wealth?

How

to Become a Billionaire

Now multiply that $13 by millions and billions. And now further

imagine you do that year after year, as many corporations controlled by a

single individual do. Except for his propensity to squander money and cheat,

Donald Trump’s solely owned Trump Organization really would be worth more than

$10 billion today thanks in good part to legal tax deferral.

Wage-earners, small and medium-sized businesses are not allowed

this deferral, except in retirement plans.

But you don’t get the same tax deal.

When you collect from your pension, IRA or 401(k) you won’t

enjoy the low rates Congress levies on capital gains even though most of the

money in your retirement plan comes from such gains.

Congress says you must pay at the higher rate for labor, up to

37%. Except for those so poor they are exempt from all income taxes you will be

burdened more than the owner of a company that deferred.

More

for Their Heirs, Too

Also, while business owners can exempt more than $11 million from the estate tax, whatever is left in your retirement plan when your time runs out will be fully taxed before your heirs collect a dollar. And it will be taxed at the highest rate your heirs pay.

Indeed, under new rules if you leave

$4 million or more your heirs will be taxed at the highest income tax rate

while heirs of a business owner leaving the same would pay nothing.

Paying higher tax rates and losing out on the estate tax

exemption are not the only way Congress puts workers at a disadvantage to the

wealthiest business owners.

Those 0% interest loans are not free. Someone had to extend the

loan money. That someone is you. A dollar of tax not paid is no different from

a dollar given out by our government. And in this area, we are talking in

billions, perhaps trillions, of dollars of interest-free loans.

Here’s how you pay. Congress spends each deferred $1 today. To

cover that expense, it borrows money equal to what is deferred.

At the current blended average federal borrowing rate of about

2%, the value of the tax-deferred for three decades will cost you 81 cents in

interest paid on government debt.

But wait, it gets worse.

After taking those interest payments into account our government

will net 19-cents on each dollar of tax-deferred for 30 years.

Warren

Buffet Gets a Free Loan

One of Warren Buffett’s companies has a loan that, the last time

I found it in his disclosure filings, was worth $660 million. Half of it would

still be unpaid 38 years later. With apologies to Mel Brooks, it’s nice to be

Warren.

Thanks to dynasty trusts that help generations build wealth even

as the number of descendants expands and to the eternal nature of corporate

persons, deferring a tax is one of the most lucrative opportunities out there.

These are riches made first in the marketplace, where riches

should be made. But then they grow. thanks to the stealth welfare program.

How

to Change It

Solutions?

- Require one set of corporate books

- Have government define profits

- Ditch the cumbersome system of reconciling Generally Accepted Accounting Principles to tax rules

- Ensure that income taxes are paid under the same rules as your pay – when you make your money

Congress could end all existing deferrals. It did in 2017 for

profits siphoned out of America untaxed and nominally held overseas. The

Republicans established that principle in the Trump/Radical Republican Tax Law

in 2017.

To prevent a shock to the system, Congress could require

companies to:

- declare how much is deferred

- send the IRS a detailed report documenting this

- allow companies to spread tax payments across four years with an annual interest charge on the unpaid balance

A rate equaling our government’s blended-average borrowing rate

would be a boon to these companies. That rate plus 1 percentage point —

so about 3% — would encourage prompt payment.

Failure by the Biden administration and the majorities in

Congress to address this stealth welfare for the rich would be a betrayal of

the voters.

It would run contrary to the promise in the preamble to our

Constitution to promote the general welfare.

But unless you spread the word so people know how they are

paying taxes to make zero-interest loans, this burden on working Americans will

continue.

ACTION

BOX / What You Can Do About It

Tell

President Joe Biden and your senators and representatives that it’s time they

fix the inequities in our tax laws that let the richest Americans get by with

paying much less than you or your neighbors.

Call

the White House at 202-456-1414.

Call

the U.S. Capitol at 202-224-3121. Ask for your senators or representative by

name.

Find your representative here and write

to them at: [Name] U.S. House of Representatives / Washington, D.C. 20515

Find your senators here and write to them

at: [Name] United States Senate / Washington, D.C. 20510

The Ways and Means Committee is the tax-writing committee in the House of Representatives. Contact chair Rep. Richard Neal (D-Mass.) at 202-225-3625. The ranking Republican is Rep. Kevin Brady (R-Texas) at 202-225-4021.