It’s an election year budget

By Will Collette

This is an election year and the CCA wants to hold on to its Town Council majority as it has for over a decade.

Between Planning Commissar

Ruth Platner’s shady land deals and the $3 million oopsie, this budget has

become a political statement that the CCA hopes will get voters to forget their

financial escapades over recent years, including their record of raising taxes. This year, the tax increase is disguised.

After months of defensiveness, the Budget Commission has

come forward with a $28,939,953 total budget that they say is around $1.3 million

less than last year.

You may recall that last January, the Budget Commission was

told by town auditors that a string of errors stretching over more than a year

led to the $3

million oopsie. In plain terms, the Budget Commission discovered it had $3

million less in its unassigned fund balance than it thought and spent mainly to

try to prevent a hike in the tax rate.

The town, and particularly the Charlestown Citizens Alliance

(CCA) prefer to call the oopsie a mis-assignment, misallocation, or some other “mis”

word (misdirection comes to mind), any term other than a MISTAKE.

Throughout the long reign of the CCA, we’ve come to learn the CCA never makes a mistake, or at least will never admit to one. Not

only does the CCA seem incapable of admitting error, but they will go on the attack against anyone who points out their mistakes.

The $1.3 million reduction in the proposed budget should

actually be a million dollars higher because three one-time expenses in the

current year’s budget are not in the proposed budget: the Old Mill Road project

at $1.8 million, OPEB healthcare at $285,000 and an extra pension contribution

of $230,000.

|

| Allan Fung, who is happy to take our money |

The Budget Commission also threw in $410,617 of one-time new

funding from the American Rescue Plan Act (ARPA), even though we just hired two

consultants, one being Republican Second Congressional District candidate Allan

Fung, to help us figure out how to properly spend the money.

But why should that concern deter the Budget Commission from

spending the money anyway? Hey, they

only listen to consultants who tell them what they want to hear as they did

when they came up with a new

Unassigned Fund Balance policy.

Plus,

they are apparently violating their own new fund balance policy by using

one-time funds – the ARPA money – to pay for annual operating expenses.

One budget surprise is the lack of any apparent effort in the proposed budget to re-build the unassigned

fund balance that was $3 million less than the Budget Commission thought it

was. Their new fund balance policy anticipates building up the surplus

to $10 million which would have required a whopping tax hike.

The proposed budget presumes a $369,662 payment increase for the Chariho School system. About half of Charlestown’s total budget is spent on Chariho.

However, Chariho’s

budget was rejected by a majority of voters in Charlestown, Hopkinton and

Richmond earlier this month.

Chariho is putting a new reduced budget before the voters on May 4. We don’t know yet what effect that will have on the

$370 thousand increase assumed in our proposed budget.

Even though the proposed budget anticipates an increase in

departmental expenditures of around $200,000, it expects to make up for it by

cutting $1.4 million in capital expenditures (hopefully by ending Ruth

Platner’s open space buying spree, but I’m not holding my breath).

They also expect to collect an additional $859,791 in taxes even

though they call for holding the tax rate (a.k.a. the mil rate) at $8.18 per

thousand. The only way to increase tax collections by a projected 3.73% is

through higher tax assessments. No matter how you parse it, this is a major tax increase.

Charlestown’s tax base

Right now, the Budget Commission estimates that all the

taxable property in Charlestown is worth almost $3 billion. The exact total of

our “Grand List” is $2,887,328,019. About 60% of that is south of Route 1, at

least as long as that land stays above water.

This is the real underpinning for the town’s finances. The

pandemic brought an influx of rich people from out of state who bought property

in town and drove up property values. That’s not going to last especially as

the impact of the climate crisis sets in.

There is another

shady deal in the works for the town to buy another over-priced parcel for

at least $800,000 (CLICK HERE for details). Not only

will that land cost a lot of money, it will remove $312,800, its current

assessed value, from the tax base.

Platner has done several

deals like this in the past few years that cost money to buy and reduce our

tax base. And she and her husband Cliff Vanover claim – without evidence – that

this actually boosts the tax base.

We also lose tax base dollars for the property owned by Charlestown’s

two fake fire districts – Shady Harbor and Central Quonnie. Shady Harbor’s real

estate holdings are tax exempt and Central Quonnie’s are assessed at

ridiculously low amounts. CLICK

HERE for more details.

We lose tax base dollars on properties that are improperly

zoned. Our former town Planner Ashley Hahn raised this issue years ago and

Commissar Platner promised to fix it, but never did. CLICK

HERE for details.

We don’t tax properties owned by the town, the state, the

federal government, most non-profits, and churches. We give tax discounts to

veterans, the disabled, low-income elderly, and the blind. Lots of land is

tax-favored when the owners grant conservation easements or take part in the Farm,

Forest and Open Space program.

These latter tax policies are reflections of town values to

honor veterans, help people who need it and encourage land conservation. But

they reflect the zero-sum nature of budgeting: to reduce taxes for some means

increasing taxes for others.

What’s not in the budget, but should be

|

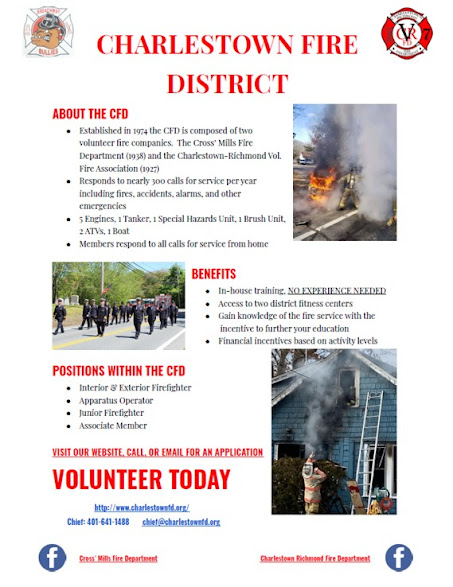

| A tax credit could put a big dent in CFD's volunteer shortage |

For example, it would help our active fire

companies to fill their ranks with much needed volunteers if the town offered a

substantial tax credit to those who serve.

We could use our tax policy to encourage the switch to green

energy by offering property tax credits to homes and businesses that install

and maintain energy sources that reduce our dependence on fossil fuels.

Finally, we should re-think whether to offer year-round

residents a Homestead Tax Credit as many coastal communities do – e.g. Narragansett

where full-time residents get a 10% discount on their assessments. CLICK

HERE for details.

The CCA

killed the idea of the Homestead Tax Credit at the behest of their

financial supporters among the absentee property owners. Since some of them are

now permanent residents, maybe it’s time to look at the idea again.

Taxes are the price we pay for a civilized society, as the

late Supreme Court Justice Oliver Wendell Holmes put it. I don’t mind paying

taxes as long as they are fairly levied and properly spent. But in Charlestown,

we are far from that ideal.