Town Council asks legislators to seek General Assembly approval for a Homestead Exemption

By Will Collette

In many Rhode Island municipalities, lots of property is

owned by non-residents. This is especially true in coastal communities like

Charlestown where waterfront properties are often bought by wealthy

non-residents for far more than the tax assessed value of those properties.

Thank you to our CRU Charlestown Town Council

members. Looking forward to quick action to enact a

town ordinance.

Charlestown’s summertime population jumps from around 8,000 to

almost 30,000. The influx of non-residents

requires the town to maintain an infrastructure that supports three times the

number of full-time residents. We need roads, facilities, town staff and public

safety investments to support all those extra people. The town even organizes

volunteers to pick up trash from around their homes and along the

roadways.

Our neighboring towns address these burdens by offering a

Homestead tax break to permanent residents that, in many municipalities, takes

the form of a reduction in the tax assessment. Most recently, South

Kingstown got General Assembly approval for a new ordinance that would

reduce the tax assessment of full-time residents by up to 10%.

On April 14, the Charlestown Town Council, comprised

entirely of Charlestown Residents United (CRU) members, voted to seek General

Assembly approval for similar homestead exemption similar to South Kingstown. It’s

very likely the legislature will approve this request.

What does this

mean to you?

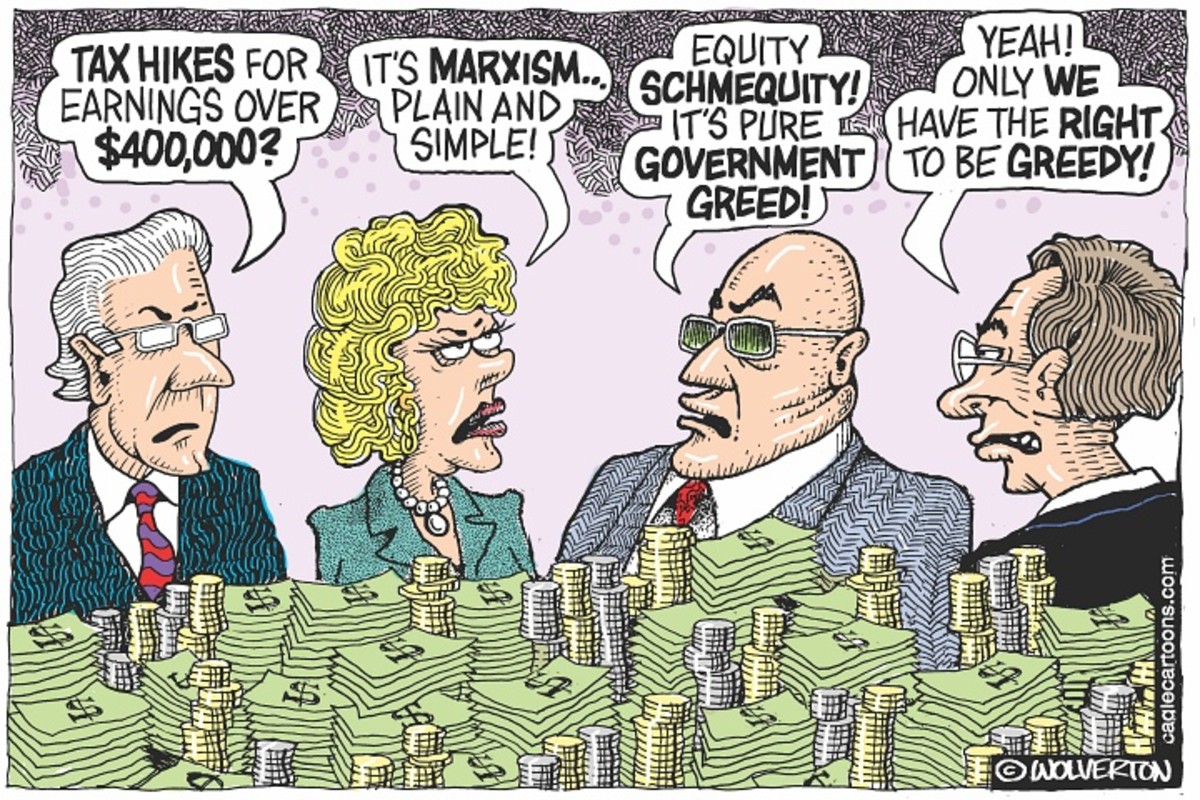

In 2011, Charlestown Town Democrats proposed a flat $1000

homestead tax credit, an idea that was obviously ahead of its time, but

were beaten down by the Charlestown Citizens Alliance. They organized what

I dubbed “the riot of the rich,” mobilizing non -resident property owners to

violently protest the concept.

The CCA and its absentee owner-benefactors argued a tax

credit wasn’t fair (“class war” they said) that could motivate wealthy property

owners to leave or to boycott local services and charities.

Those arguments were pretty lame back in 2011 and even more

so today. Out-of-state owners are paying mega-bucks for Charlestown properties.

If they decide they want to leave because their tax goes up by a few thousand, that’s

fine since we seem to have a big pool of buyers ready to pay as much as a

million or two more than assessed value.

And seriously, are these absentee homeowners going to mow

their own lawns, fix their own plumbing, clean their own houses and swimming pools, or

bring their groceries with them from Manhattan?

I'm sure non-residents grab a bite or two at local eateries, but I suspect their tastes run more to the cuisine at Ocean House, not Monahans.

As for donations, other than the CCA’s campaign fund, where else do donations from non-residents go?

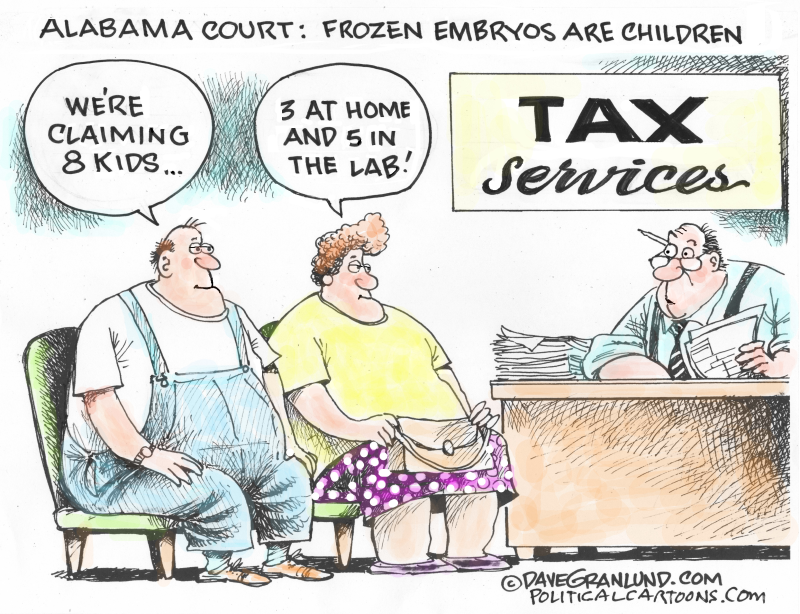

All told, the main contribution non-residents make to Charlestown’s economy is in the form of their property taxes. A Charlestown homestead exemption will simply increase their share to compensate the town for their out-sized impact on the town’s costs.

Depending on the final size of the exemption, i.e. what percentage, and the assessed value of your home, you will save on taxes and pass the cost of those savings onto to absentee landowners.

Only a tiny peep from the CCA

I was a bit surprised to see a relatively muted response

from the Charlestown Citizens Alliance to the Town Council’s recent action compared to their 2011

freak-out.

Here’s

how they describe the history of the fight over the homestead tax break:

Over the years, there have been proposals to enact a

Homestead Exemption. These would have exempted a percentage of the assessed

value of real property from taxation for certain taxpayers. One group of

taxpayers would have received the exemption, but because the town would have

needed to collect a given amount of revenue to provide services and support

capital improvements, another group of taxpayers would have needed to pay the

difference. None of these proposals has received support from the community in the

past.

Notice no mention of the CCA’s leadership of the opposition to the homestead tax break since 2011.

They are also cagey about saying the truth: the homestead tax break would

benefit those of us who make Charlestown their home while non-resident property

owners would, as the CCA puts it, “pay the difference.” Another important, but

unmentioned, factor is how much the CCA counts on political donations from

non-residents to fill their campaign coffers.

The CCA also claims there was no support for a homestead tax break from the community. Well, the CCA ensured there would be none by shutting down all discussion about this tax break for years after their political donors objected. Town voters rejected the CCA in the last two elections so the CCA’s claim is no longer valid.

Finally, the CCA blandly complains that “There seems to

be a rush on the part of the Council to get this authority” but admit “it

is late in this year’s legislative session.”

Even though it is late in the 2025 General Assembly session, Town Solicitor Peter Ruggiero told the Council on April 14 that there were ways to get action on legislation this year.

Back in 2011, I supported a flat rate Homestead tax credit of $1000. I still like a flat rate because it would provide the greatest amount of tax relief to owners of lower priced homes. But I’m OK with a 10% exemption.

Under the 10% plan, the higher your assessment, the bigger your assessment.

That obviously favors high-end properties, unless the Council decides to cap

the assessment subject to exemption, like $1 million just for the sake of

argument. But everyone who makes Charlestown their home can benefit.

These are all questions to be addressed if the General

Assembly authorizes Charlestown to proceed to craft an ordinance. That is a

lengthier process and all the more reason to take this modest first step.

That’s not rushing it – this tax break for Charlestown residents is 14 years overdue.

.webp)