That's No Cause for Celebration

|

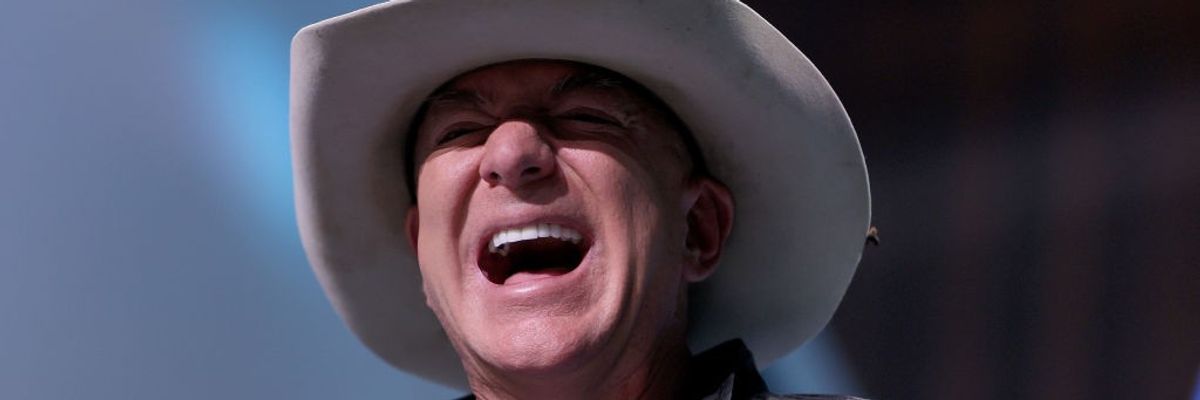

| All hat, no cow. Jeff Bezos laughs during a press conference on July 20, 2021 in Van Horn, Texas. (Photo: Joe Raedle/Getty Images) |

It’s been a full decade now since I first predicted — warned, to be a bit more precise — that America would have its first trillionaire before 2040.

I stand by that warning today. Unfortunately, everything I said ten years ago has aged well. Too well. I explained back then how tax policy was supercharging the accumulation of obscene fortunes in America.

Policymakers, I

noted, had lifted the lid on wealth accumulation by decreasing taxes on

inheritances and income from capital. That policy failure would go on to become

substantially worse in 2017 with the passage of the Tax Cuts and Jobs Act.

Others would see this same ominous trend. In an interview with CNBC, several experts recognized the distinct possibility the world would have its first trillionaire by 2039, the year CNBC would turn 50.

They offered various explanations for how

that would happen, with most of them agreeing it would “take several Bill Gates-like

successes from one individual to reach the trillion-dollar mark.”

I saw things differently, telling CNBC: “It might take the

founder of five of today’s Microsofts to reach a trillion, but we’re going to

see larger and larger Microsofts.”

More recently, the idea that a larger Microsoft would deliver

our first billionaire has gained traction. Three years ago, USA Today reported

on predictions that Amazon would raise Jeff Bezos’ wealth to trillionaire level

as early as 2026.

Those predictions have turned out to be a bit aggressive —

Bezos’ wealth climb has leveled off — but they may have been beneficial in an

odd way. Historically, far too many Americans have looked at billionaire wealth

the way they look at sports, as I noted in 2014:

The super-rich are setting new records, $10 billion, $50 billion, and soon enough $100 billion. Rather than objecting, our nation celebrates the increasingly obscene fortunes of the super-rich as we do athletes breaking sports records.

Reaching $1 trillion will be what hitting 73 home runs was before we knew Barry Bonds cheated to get there.

Will our first trillion-dollar fortune also be tainted by misdeeds of the achiever? Could that be what finally wakes us from our slumber?

In 2020, with Americans dying in large numbers from the

pandemic, Bezos had become to billionaire wealth hoarding what Barry Bonds had

become to home run records. As noted by USA Today, the reporting on

Bezos becoming the first trillionaire occurred when Amazon workers were

publicly protesting over safety issues.

Which caused the appropriate response to his predicted

trillionaire status — anger — at least on Twitter. One tweet disdainfully

noted: “Jeff Bezos will sometime in the near future have more money than the

Netherlands. Totally normal. Nothing out of order here.” Another considered a

headline announcing Bezos’ impending trillionaire status the most “disgusting and disturbing”

he’d seen.

The reaction to trillionaire talk three years ago,

unfortunately, may have been an anomaly, not the turning point I hoped it would

be.

A case in point: The Motley Fool, a financial and investing advice company, has recently been promoting investment in a corporation it suggests could be as large as 17 Amazons, with a market capitalization of $17 trillion, an accumulation that would create the world’s first trillionaire.

The promotional material doesn’t give the name of

the corporation. To find it, you’d at least need to provide an email address,

which would mean lots of unwanted promotional emails. Apparently, this

corporation has technology that could supercharge artificial intelligence, or

AI.

But the identity of that corporation — or the founder who stands

to become the first trillionaire — isn’t the point here. After all, absent

significant reform of America’s tax policy, we will see our first trillionaire,

probably not much more than a decade from now.

Worse, too many folks may think that would be a good thing. In

its promotional ad, Motley Fool gushes over how excited the prospect of a $17

trillion corporation headed by a trillionaire has investors, as if the

super-rich becoming richer rates as a good thing in and of itself.

Most troubling: Motley Fool is using the prospect of someone

achieving a net worth over $1 trillion as a selling point. This sort of

advertising works because we have millions of investors out there who emulate

the billionaire class.

Which brings us back to tax policy. Halting, then reversing, the obscene concentration of wealth in America will require Americans in overwhelming numbers demanding real tax reform.

Without that tax reform, the

concentration of wealth will worsen and, before we know it, we’ll see the

arrival of our first trillionaire. And as our concentration of wealth worsens,

the political power of billionaires will only continue to increase.

We’ll never have the collective mentality, as a nation, to take on the ultra-rich if millions of Americans identify with them and see the chase to become the first trillionaire the same way they see a football team’s pursuit of an undefeated season.

We see this same identification in the

response of everyday Americans to estate tax reform. In large numbers, many

Americans oppose the estate tax because they think it will apply to them one

day.

To be sure, many Americans do understand the perils of concentrated wealth. But to make real progress on tax reform, we need more than a bare majority of Americans opposing extreme wealth concentration and supporting higher taxation of the rich.

We need to reach the point where

for every average American citizen who sees billionaires as role models,

another ten see them as the wealth hoarders they are.

Which means we should be fearing, not cheering, the prospect of

an American trillionaire.

BOB LORD is Senior Advisor, Tax Policy at Patriotic Millionaires and an Institute for Policy Studies associate fellow.